By Murray Wennerlund published 11-16-2024 updated 11-16-2024

|

|

|

By Murray Wennerlund published 10-13-2022 updated 10-14-2022

By Murray Wennerlund published 10-13-2022 updated 10-14-2022

To keep this post within limits I'll be working on a classic housing scenario.

According to FEMA, Risk Rating 2.0 will:

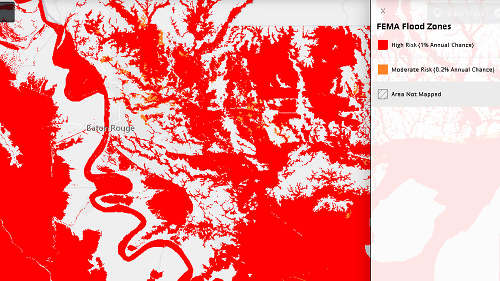

Currently, the National Flood Insurance Program (NFIP) has followed the same practices put in place since the 70's. The NFIP use basic information to classify properties if they are a flood risk. Then they use Flood Insurance Rate Maps (FIRM), occupancy and elevation of the structure.

The example home that was built in 1963 at an elevation of 41' above sea level would have had to be elevated each time the FIRM data was changed. If the home was elevated following the FIRM Map updates the home would not have flooded until 2016. The home was at risk and if built 1 foot over BFE the home would have been saved. The costs to the homeowner to elevate each time the FIRM map was updated would not be cost effective to the homeowner. The home if elevated would not bring additional value to the home in it's current area. It would actually be looked at as out of place. So using FIRM data as your only source and elevating to BFE or higher only adds costs to homeownership and offers no increase in actual home value in SHFA.

With Risk Rating 2.0 flood zones will no longer be used in calculating the structures flood insurance policy costs. The insurance costs will be based on features of the structure such as the foundation type, height of the lowest floor measured from BFE and the actual replacement value of the structure. The major issue in flood events when the structure sustains more than 50% damage costs based on the market value of the home. At 51% of the market value of the structure in damages it's recommended to demolish and rebuild. At this point your flood insurance currently capped at $250,000 may not be enough to mitigate and rebuild.

Risk Rating 2.0 makes it clear that flood insurance is mandatory if the structure is located in a SFHA and the community participates with the NFIP and the mortgage on the structure is federally secured. This isn't a change to the NFIP program.

How your premium is calculated:

Structure variables and Geographical location.

Premiums and Subsidies.

In the example home, the flood of 2016 is an actual event and will be used as it's level of flooding with damage estimates associated with the level of flooding. Homes around the area that did not mitigate will be considered at risk for at least the same amount of flooding and same amount of damage. This will lead to repetitive loss.

Grandfathering.

Yes, many will be grandfathered in due to change in flood zone or change in BFE. This is a variable I will not take up right now. We're going to focus on new mortgages in current flood zones so I'm skipping, zone grandfathering, elevation grandfathering, premium grandfathering.

Premium, Fees, and Surcharges.

Let's now get into the actual costs of the example home. I will cover the structures and not contents insurance.

Risk Modeling by the NFIP

The old system only places you in a risk if you are in an area of a 1% annual chance of flooding. The new system will also include flooding due to rainfall, tsunami, Great Lake flooding, coastal erosion outside zone V and flooding in leveed areas.

Risk Rating 2.0 will be using a multi-model approach to determine new rates. It will pull data from existing NFIP map data, past NFIP policy and claims data, Untied States Geological Survey (USGS) elevation data (topographical), National Oceanographic and Atmospheric Administration (NOAA) SLOSH Storm surge data, and the U.S. Army Corps of Engineers data sets focused on areas behind levees.

How will FEMA estimate future disaster losses or the potential for loss?

FEMA will be using catastrophe models to determine approximate disaster losses. Disaster events such as hurricane winds, storm surge, river and rain flooding, tornadoes, earthquakes and wildfires. These elements have been used by the insurance industry to determine risk. Catastrophe models seem more accurate due to the lack of historical disaster data collected and shared. With each model and disaster scenario the program is able to calculate an event rate or the vulnerability of the property to that particular disaster scenario.

What Risk Rating 2.0 modeling actually does that can not be denied is create and store historical events. These historical events such as the 2016 floods will create the baseline data that is needed to determine future risk. Even with mitigation such as the Comite Diversionary Cannel many areas south of the protection will not change their flood risk. And under the catastrophe modeling the failure of pumps or levees would be added to at least some of the modeling events.

Replacement Cost Value.

The current NFIP rating system, rates are based on the amount of insurance purchased for a structure rather than the replacement cost of that structure.

NFIP uses the first $60,000 of building coverage for a single family residence and $25,000 of contents coverage as the basic price line. NFIP charges more for coverage below the basic price line because those households would most likely to have more losses that are not covered by the current NFIP policy.

By charging a higher premium rate for NFIP the program is able to better cover underinsurance damage claims. It also encourages homeowners to increase the level of coverage. Currently limits are set at $250,000 for residential homes which does not match the average market value of homes in the nation. FEMA appears to average the value of a home based on grouping homes which will more often decrease the actual structure value for many homeowners.

The replacement cost value is used for setting NFIP premium rates. FEMA anticipates that structures with higher replacement costs than local or national averages would actually be paying more for NFIP coverage when compared to homes that are below the average which would pay less. FEMA uses the structures zip code, square footage of the structure, number of stories and the year the structure was built to determine the replacement cost value.

Mitigation Credits in Risk Rating 2.0

FEMA is contemplating credits for the following mitigation efforts:

At this time the only mitigation practice that the NFIP gives credit for is the elevating of the structure and flood proofing in certain cases.

Risk Rating 2.0 and Flood Zones

Flood zones will not be used in calculating a property's flood insurance premium when using the Risk Rating 2.0 system. The premium is calculated based on the specific features of the individual property. The caveat to this is, all new construction and substantial improvements to buildings in zone V must be elevated. SFHA will still have mandatory NFIP purchase requirements. This may create an environment that will nullify any need for grandfathering structures and property.

The Maximum Premium Increases Under Current Statute.

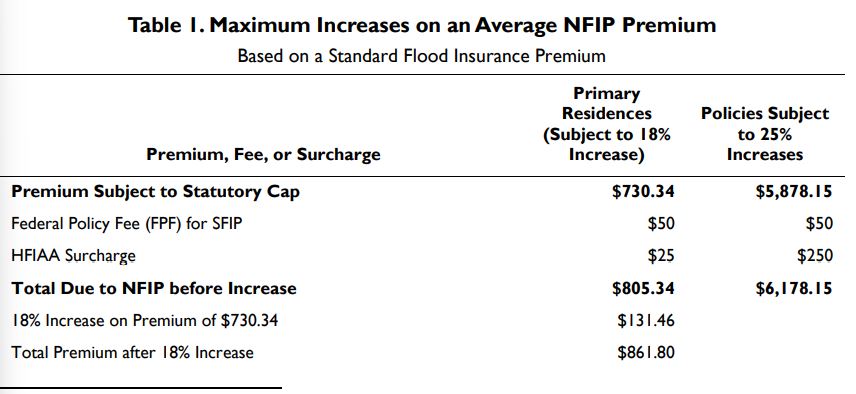

FEMA has statutory authority to set premium rates. FEMA also sets the annual premium increase caps. The Risk Rating 2.0 will not be able to increase beyond these caps set by FEMA. Homeowner Flood Insurance Affordability Act of 2014 (HFIAA) set allowable rate increases for primary residences at 5% to 18% per year. Rate classification increases are capped at 15% per year. To clarify, the average yearly premium rate increase for your primary residence with a single risk classification rate may not increase more than 15% a year, while the individual premium rate increase for any individual policy may not increase more than 18% each year. Other categories of properties are required to increase by 25% per year until they reach full risk-based rates, this group includes;

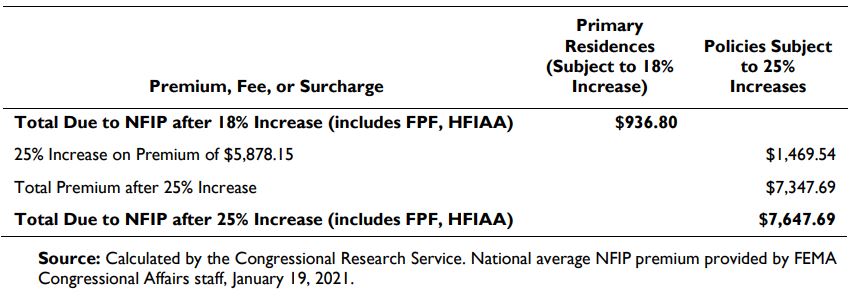

FEMA does not consider everything that policyholders pay to the NFIP to be part of the premium and therefore subject to these caps. The statutory caps according to FEMA only include the building and contents coverage. ICC, SRL and other fees and surcharges are not considered part of the premium and therefore are not subject to the premium cap limitations. This also includes the Federal Policy Fee, the HFIAA surcharge and if applicable the probation surcharge.

Table 1 below shows the effects of a maximum statutory increase on the national average premium for a Standard Flood Insurance Policy (SFIP) that is subject to the 18% increase and a 25% increase, respectively. The 25% increase amount is to bring the lower rate up to what the insurance premium rate should be. This amount includes building coverage, contents coverage, increased cost of compliance (ICC) coverage, and SRL (severe repetitive loss) premium if applicable. It also reflects any optional deductibles, community rating system discounts. FEMA estimates the national average for policies subject to the 25% rate increase is $5,878.15 and the national average for all other policies that are not subject to the 25% rate increase is $730.34. The national average premium for all NFIP policies is $818.70 according to FEMA.

SFIP primary residence, the maximum 18% increase would be calculated on the premium of $730.34, leading to an increase of $131.46 and a new premium of $861.80. However, an SFIP primary residence would also pay an FPF of $50 and a HFIAA surcharge of $25, so the total amount due to the NFIP after an 18% increase would be $936.80.

An SFIP for a property subject to a 25% increase on the initial premium of $5,878.16 would lead to an increase of $1,469.54 and a new premium of $7,347.69. Costs for such a policy for a nonprimary residence would also include an FPF of $50 and a HFIAA surcharge of $250, so the total amount due to the NFIP after the 25% increase would be $7,647.69.

Opinion of Risk Rating 2.0 and the NFIP program.

One of the main arguments people make about any new insurance is the actual premium costs per year. For some, the rates are going to go up. For most according to what I have seen in Louisiana rates should decrease if the homeowner followed the most basic of mitigation practices.

One rule that can not be argued, if you have ever flooded then you are in a flood area. You can't fall in line with the "It's a 1,000 year flood." when you don't have 1,000 years of flood data. You also can't fall in line with those that say it will not happen again, just ask any of the 1980's flood survivors that experienced flooding in 2016. In many SHFA your 30 year mortgage may actually represent 3 major flood events. That's recorded history and the reason repetitive loss is going to cost if you do nothing to reduce your disaster losses.

I have often told people you must reduce your disaster debt burden and if you don't you can expect on average a 33% net worth loss each and ever major to severe disaster occurrence or when your structure is substantially damaged.

I don't see a problem with the Risk Rating 2.0 system in how it calculates your premium and I don't see an issue with the actual premiums. What I do find is that the maximum amount of coverage will not cover the replacement costs of a home in todays up and down building market. Most every builder will tell homeowners looking for new construction that the costs will be well over the homes market value. With FEMA taking the average home replacement costs in your area to determine your homes replacement cost many will see that they don't have enough to actually replace their home with the NFIP offering. If the average retail home cost $350,000 and building a new home costs 30% more the maximum of $250,000 in NFIP funds will not be enough for a homeowner to reconstruct. Then when you factor in the costs of elevation which is not included in the NFIP caps but is referenced in the ICC amount the $30,000 ICC is not enough to construct the elevated foundation and platform needed.

When we look at rate increases we also need to review substantially damaged home reconstruction and replacement values and costs. If you're flooded today with the full coverage of NFIP on a 2,100 square foot home you would be out of pocket for an estimated $184,700. That out of pocket may actually be your homes market value based on the houses around you according to FEMA.

The risk rating 2.0 system shows how FEMA is covering for it's federal tax dollar spending but it does not actually cover the homeowners recovery after a disaster.

A new home built in low income areas during the years between 2020 and 2022 in Louisiana costs and estimated $157 per square foot.

2,100/sf home x $157 = $329,700 reconstruction coverage $250,000 overage of $79,700.

Estimate to built foundation and elevated platform is $50/sf which only covers the wall area of your home and not any landings or porches that you will need if you are living the elevated home lifestyle. Estimate $105,000 for elevation.

Now you have $184,700 in total out of pocket overages due to not having enough NFIP coverage to completely replace your home. Again, this amount ($184,700) may actually be greater than your pre-disaster market value which will not be easy to mortgage especially if you are in a SFHA.

In conclusion, the Risk Rating 2.0 method is logical but if we actually add in mitigation the caps fall short of todays actual costs. Even if you apply the Hazard Mitigation Grant Program that is a cost sharing program for homeowners (25% homeowner responsibility, 75% FEMA) you still have issues of coverage because this grant is a duplication of benefits to other grants and insurances secured by the federal government.

Without additional programs being able to assist and waiving the duplication of benefits and cost share requirements of the Stafford Act flood insurance will still be just additional debt for homeowners with little value after a catastrophic event as listed by FEMA and used by FEMA to determine the new rates you will be soon paying.

Research Resources: