By Murray Wennerlund published 11-16-2024 updated 11-16-2024

|

|

|

By Supervisor published 5-31-2018 updated 12-15-2018

By Supervisor published 5-31-2018 updated 12-15-2018

The best example is ICC which stands for Increased Costs of Compliance.

This typically is when you are looking to protect your assets from repeated damage from disasters.

Elevation is on that list of mitigation items you are reviewing to prevent future disaster claims.

Let's take our typical homeowner case after a disaster.

We'll focus on homeowners that have Flood (NFIP) insurance because it is only those that have the additional insurance that qualify for ICC (Increased Costs of Compliance)

Example:

Let's say your home flooded in the 2016 Floods DR4277

Total Repair Costs with Mitigation for Elevation = $220,000 (Costs)

Total Grants Awarded: $30,000 (DOB)

Total NFIP Payout: $100,000 (DOB)

Additional NFIP ICC: $30,000 (DOB)

Total of all DOB Payouts: $160,000

Total Project Costs $220,000

Less Benefits (DOB) $160,000

Balance UNMET needs: $60,000

In this case the homeowner still has $60,000 in UNMET needs which can be then picked up in part or whole by another federal grant program such as HUD CDBG-DR.

In our case the dreaded Duplication of Benefits issue isn't an issue simply based on the total dollar amounts needed to mitigate and repair the example home.

Each case is different so don't count out HUD CDBG-DR Grants simply because your neighbor told you your DOB is very high. Your neighbor doesn't know the whole story and the true costs to mitigate after a disaster.

I'll explain in more detail.

In the above case example the homeowner opted to Mitigate and would be using one of the FEMA plans; Hazard mitigation Grant Program, Pre-Disaster Mitigation Program, Flood Mitigation Assistance Program.

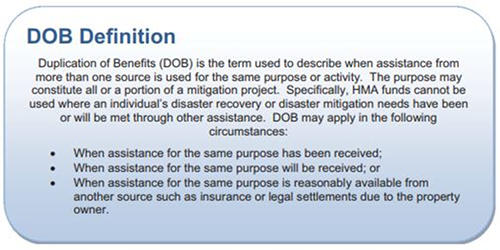

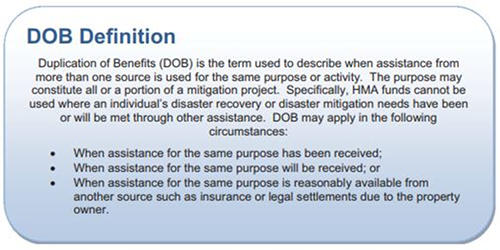

What is a Duplication of Benefits?

Under the Hazard Mitigation Assistance Programs it is when you receive or will receive or could receive if available to the homeowner any assistance from any federal source that can offer federal assistance money.

DOB is really about not doubling payments for the same repair or project or collecting more money than actually needed for the repairs or collecting additional money so to make repairs and enhancements to property for increased value and not increased mitigation concerns.

The duplication of benefits can happen at any time and many times the homeowner is not aware that the benefits are actually a duplication.

Fraud applications are very low when compared to actual valid claims.

During the grant cycle from one federal grant to the next additional monies may be provided or be available.

The "Available" funds could be in the form of a Secured Federal Loan from the SBA simply called a SBA Loan.

This is the "Reasonably Available" to money part that federal, State (Grantee) and Local (Sub-Grantee / Sub-Recipient) governments identify most often.

It's the homeowner that is responsible for reporting any possible duplication of benefits to the Subgrantee which will then report to the Grantee (State level) then to FEMA or the main federal agency offering the grant.

A duplication "Review" for a lack of a better term can happen at anytime.

During the application process before even being approved for the grant a DOB check is made.

During the actual grant period distributing the money audits can be made and if DOB is detected adjustments to the grant award made.

During the closing of the grant a review could detect DOB.

After the grant closing for many years if any funds are received at a later date these would also be a duplication of benefits if they are given for the same project.

The property owners need to report any possible DOB to not put in jeopardy additional grants that you are applying for.

Property owners also need to be very realistic with the actual money awarded to each project. It is very rare to hear a homeowner / property owner was ever given enough to completely repair to pre-disaster conditions. We always see additional costs, material costs, labor costs increase which are not covered.

Be wise with the grant money and you may actually be able to recovery from the disaster without to much additional debt.

Resources: